Interview Questions

Senior Account Executive Credit Unions Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Senior Account Executive Credit Unions?

A senior account executive at a credit union is responsible for managing the day-to-day operations of the credit union, as well as developing and implementing strategic plans. They work closely with the credit union's board of directors to ensure that the credit union is meeting its financial goals and objectives.The senior account executive is also responsible for developing and maintaining relationships with the credit union's members, as well as other financial institutions. They work to ensure that the credit union is providing its members with the best possible service and products.The senior account executive position at a credit union is a very important one, and it takes a great deal of experience and knowledge to be successful in this role. If you are interested in becoming a senior account executive at a credit union, you will need to have a strong background in finance and accounting. You should also have excellent communication and interpersonal skills, as you will be working closely with members and other financial institutions.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Senior Account Executive Credit Unions fit into your organization?

A senior account executive for credit unions typically works with financial institutions and helps them to develop credit union relationships. This person is responsible for identifying new business opportunities, negotiating and maintaining credit union contracts, and providing account management services. They work closely with the credit union's management team to ensure that the credit union is meeting its goals and objectives.

What are the roles and responsibilities for a Senior Account Executive Credit Unions?

-Research and develop new business opportunities with credit unions-Analyze credit union financials and trends-Prepare and present sales proposals to credit union decision makers-Negotiate and close new business deals with credit unions-Build and maintain strong relationships with credit union executives-Achieve quarterly and annual sales targets set by managementSenior Account Executive Credit Unions Skills And Qualifications -Bachelor's degree in business, finance or related field-5+ years of sales experience, with at least 3 years of experience selling to credit unions-Strong understanding of credit union products, services, operations and regulations-Excellent communication, presentation, negotiation and closing skills-Self-motivated, results-oriented and able to work independently-Proven track record of achieving sales targets

What are some key skills for a Senior Account Executive Credit Unions?

When interviewing for a Senior Account Executive Credit Unions, be prepared to discuss the skills that are important for the role. These skills may include:• The ability to develop and maintain relationships with key decision makers at credit unions• The ability to identify and assess opportunities for business development within credit unions• Strong presentation skills• Strong negotiation and influencing skills• The ability to manage and grow a book of business• The ability to work independently and take initiativeWhat experience is important for a Senior Account Executive Credit Unions?When interviewing for a Senior Account Executive Credit Unions, be prepared to discuss your experience in the industry. In particular, employers will be interested in your experience working with credit unions. Other relevant experience may include:• Experience selling products or services to credit unions• Experience working in the financial services industry• Experience working in account management or business development

Top 25 interview questions for a Senior Account Executive Credit Unions

What experience do you have in the credit union industry? What do you know about credit unions? What do you think sets credit unions apart from other financial institutions? Why are you interested in working for a credit union? What do you think are the most important qualities for success as a senior account executive at a credit union? What do you know about our credit union? Why do you think you would be a good fit for this position? What do you think are the biggest challenges and opportunities facing credit unions today? What do you think is the most important thing credit unions can do to stay competitive in the financial services industry? What are your thoughts on the role of technology in credit unions? What do you think are the most important qualities for success in sales? What do you think is the most important thing to remember when working with clients or members? What are your thoughts on building relationships with clients or members? What do you think is the most important thing to remember when working with co-workers? What are your thoughts on teamwork? How would you describe your work style? How do you handle stress and pressure? How do you handle conflict? What are your thoughts on change? How do you handle criticism? What are your thoughts on customer service? How do you handle difficult situations or people? What are your thoughts on selling products or services? How do you handle rejection? What are your thoughts on networking? How do you handle networking events or situations? What are your thoughts on time management? How do you prioritize your work? How do you handle deadlines? What are your thoughts on multitasking?

Top 25 technical interview questions for a Senior Account Executive Credit Unions

What types of loans are you familiar with? What are the underwriting guidelines for each type of loan? How do you determine whether a loan is a good risk? What are some of the common reasons that loans are declined? How do you evaluate a borrower's creditworthiness? What are some of the common red flags that you look for when evaluating a loan application? What are some of the common mistakes that borrowers make when applying for a loan? How can borrowers improve their chances of getting approved for a loan? What is your experience with commercial loans? What is your experience with SBA loans? What is your experience with home equity loans? What is your experience with auto loans? What is your experience with personal loans? How do you determine the interest rate for a loan? How do you calculate loan payments? What are some of the common fees associated with loans? How do you structure a loan? What are some of the common terms associated with loans? What are some of the risks involved in lending money? How do you mitigate the risks of lending money? What are some of the common problems that can arise with loans? How do you handle problem loans? What are some of the collection methods that you use for problem loans? What are some of the foreclosure procedures that you are familiar with? Have you ever had to foreclose on a loan? If so, how did you handle it?

Top 25 behavioral interview questions for a Senior Account Executive Credit Unions

Tell me about a time when you had to manage a difficult customer or client. Describe a time when you had to negotiate with someone. Tell me about a time when you had to handle a difficult situation. Tell me about a time when you had to manage a complex project. Describe a time when you had to deal with a difficult customer service issue. Tell me about a time when you had to deal with a difficult sales situation. Describe a time when you had to manage a complex account. Tell me about a time when you had to negotiate with a vendor. Describe a time when you had to deal with a difficult financial situation. Tell me about a time when you had to manage a difficult team.

Conclusion - Senior Account Executive Credit Unions

These are just some of the questions you might be asked in a senior account executive role at a credit union. Be prepared to answer questions about your experience working with credit unions, your knowledge of the credit union industry, and your sales and account management abilities. Be ready to discuss your experience working with clients, managing accounts, and achieving sales goals. Be prepared to provide examples of your work that demonstrate your skills and abilities. Be ready to sell yourself and your ability to be a successful senior account executive at a credit union.

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

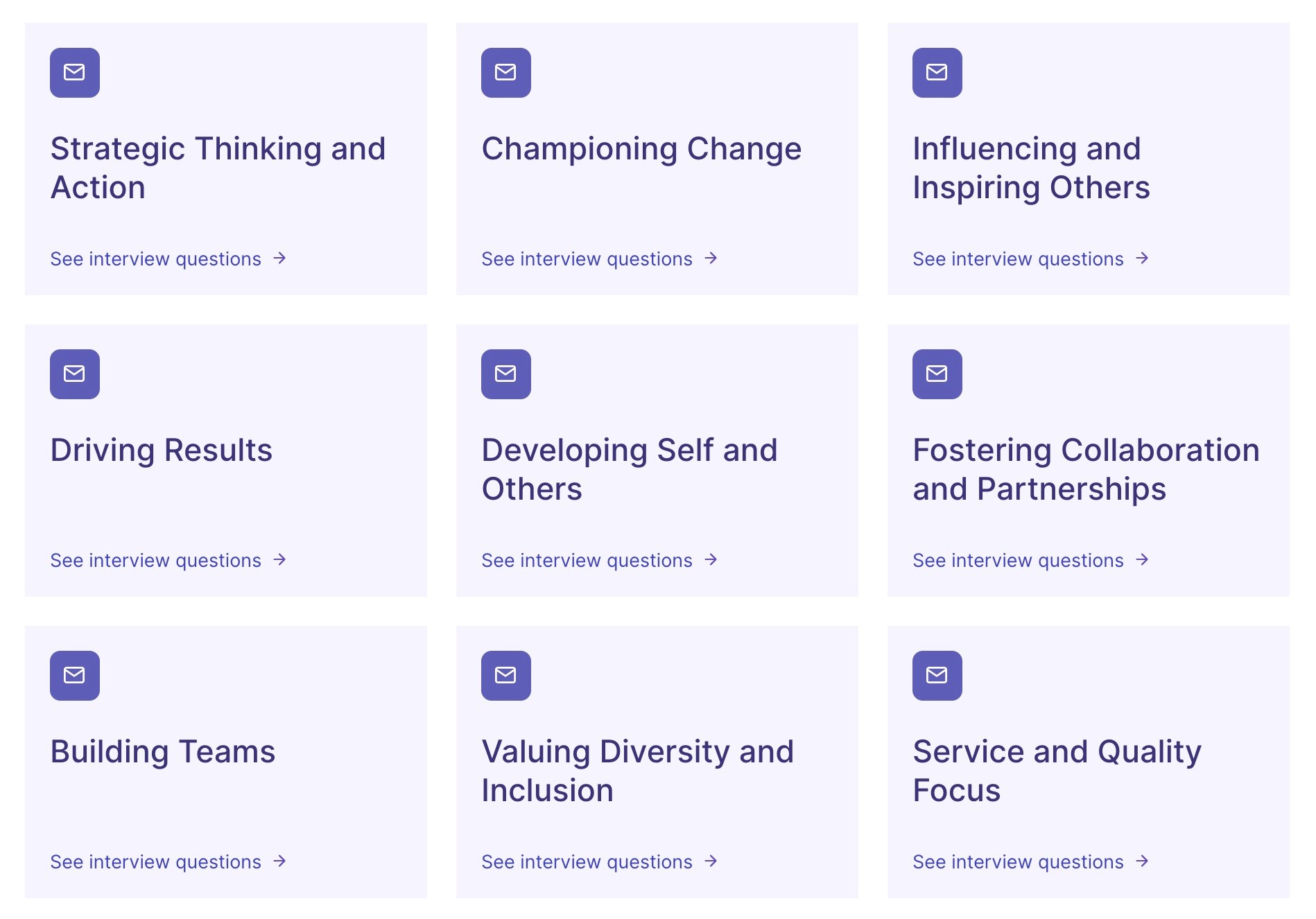

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter