Interview Questions

Quantitative Strategist DeFi Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Quantitative Strategist DeFi?

A quantitative strategist is a professional who uses mathematical and statistical models to make investment decisions. They are also responsible for developing and implementing investment strategies. Quantitative strategists work in the financial industry, and most are employed by hedge funds, banks, and asset management firms.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Quantitative Strategist DeFi fit into your organization?

As the name suggests, a quantitative strategist is responsible for the quantitative aspects of financial modeling and investment analysis. In the world of decentralized finance (DeFi), a quantitative strategist would be responsible for developing models to assess risk and opportunity in the DeFi space. In addition, a quantitative strategist would also be responsible for analyzing data to find trends and develop investment strategies.

What are the roles and responsibilities for a Quantitative Strategist DeFi?

As a quantitative strategist in the DeFi space, your primary responsibility will be to develop and implement quantitative models to trade digital assets on decentralized exchanges. In addition, you will be responsible for researching and developing new trading strategies, as well as maintaining and improving existing ones. Furthermore, you will be required to provide regular reports on your findings and strategies to the DeFi team.DeFi Quantitative Strategist Key Skills -Strong analytical and quantitative skills-Excellent programming skills in Python or R-Experience with statistical modeling, machine learning, and/or econometrics-Knowledge of decentralized exchanges and digital assets trading-Ability to work independently and take initiative-Excellent communication and writing skills

What are some key skills for a Quantitative Strategist DeFi?

Some important skills for a Quantitative Strategist DeFi include: -Strong analytical skills: A Quantitative Strategist DeFi must be able to analyze data and make sound investment decisions based on their findings. -Profitability: A Quantitative Strategist DeFi must be able to generate profits for their clients or employer. -Risk management: A Quantitative Strategist DeFi must be able to identify and manage risk when making investment decisions. -Communication skills: A Quantitative Strategist DeFi must be able to effectively communicate their investment decisions and findings to their clients or employer.

Top 25 interview questions for a Quantitative Strategist DeFi

Outline your experience working with quantitative models. What is your experience with statistical programming languages? What attracted you to the field of quantitative finance? Describe a model you created that you were particularly proud of. How do you go about validating a model? Tell me about a time when you had to explain a complex concept to a non-technical individual. What do you think is the most important skill for a successful quantitative analyst? Tell me about a time when you faced a difficult problem and how you solved it. Describe a challenging project you worked on. What do you think sets your work apart from other quantitative analysts?

Top 25 technical interview questions for a Quantitative Strategist DeFi

What motivated you to pursue a career in quantitative finance? What is your experience with developing quantitative models? What is your experience with statistical programming languages? What is your experience with financial data analysis? What is your experience with market analysis? What is your experience with trading strategies? What is your experience with risk management? What is your experience with portfolio management? What is your experience with derivatives? What is your experience with interest rate products? What is your experience with foreign exchange products? What is your experience with credit products? What is your experience with commodities? What is your experience with algorithmic trading? What is your experience with HFT strategies? What motivated you to pursue a career in quantitative finance? What is your experience with developing quantitative models? What is your experience with statistical programming languages? What is your experience with financial data analysis? What is your experience with market analysis? What is your experience with trading strategies? What is your experience with risk management? What is your experience with portfolio management? What is your experience with derivatives?

Top 25 behavioral interview questions for a Quantitative Strategist DeFi

How do you develop and test quantitative trading models? What is your experience with market microstructure? What is your experience with statistical modeling? How do you identify and quantify trading opportunities? What is your experience with algorithmic trading? What is your experience with portfolio management? What is your experience with risk management? How do you think about and manage risk? What is your experience with derivatives trading? What is your experience with quantitative research? How do you conduct research on potential investments? What is your experience with statistical analysis? How do you use data to inform your investment decisions? What is your experience with Excel or other spreadsheet software? How do you use technology in your work? What is your experience with programming languages such as R, Python, or MATLAB? Do you have any experience working with big data sets? How do you handle uncertainty when making investment decisions? What is your experience with behavioral finance? How does your understanding of human behavior inform your investment decisions? What is your experience with financial modeling? How do you build models to inform your investment decisions? What is your experience with machine learning? How do you use data and algorithms to find trading opportunities? What is your experience with data mining or predictive modeling?

Conclusion - Quantitative Strategist DeFi

These are just a few of the questions that you could be asked during a quantitative strategist DeFi interview. In order to ace the interview, you need to be prepared to answer questions about the DeFi space, your experience with quantitative strategies, and your understanding of the DeFi ecosystem. With the right preparation, you will be able to impress your interviewer and land the job.

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

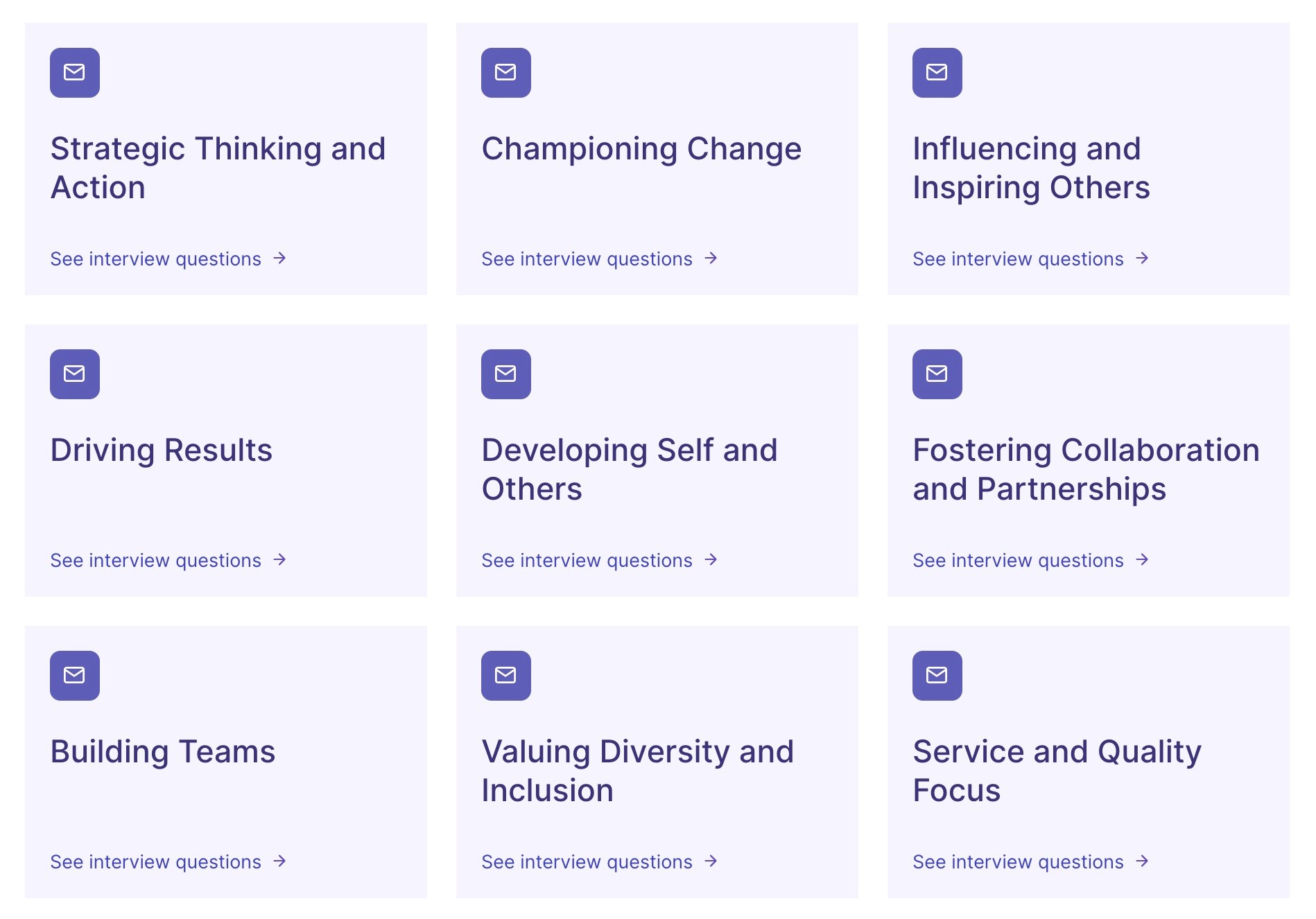

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter