Interview Questions

Manager Global Tax Compliance Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Manager Global Tax Compliance?

One of the most important aspects of a manager's job is ensuring that the company they work for complies with all global tax laws. This can be a daunting task, as there are many different laws and regulations that must be followed. A manager who is responsible for global tax compliance must have a thorough understanding of the tax laws of the countries in which their company operates. They must also be able to effectively communicate with tax authorities in those countries.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Manager Global Tax Compliance fit into your organization?

The Manager of Global Tax Compliance is responsible for ensuring that the organization's global tax compliance obligations are met. This includes preparing and filing accurate and timely tax returns, managing tax audits, and providing advice on tax planning and strategy. The Manager of Global Tax Compliance reports to the Director of Tax and works closely with the finance, legal, and accounting teams.

What are the roles and responsibilities for a Manager Global Tax Compliance?

The Manager Global Tax Compliance is responsible for all aspects of the Company’s global tax compliance, including but not limited to, US GAAP and statutory tax reporting, US federal and state income tax compliance, foreign income tax compliance, and indirect tax compliance. The role includes management of the Company’s transfer pricing policy and documentation. The role also includes management of the Company’s global tax provision process and quarterly/annual tax forecasting process.Key Responsibilities • Manage all aspects of the Company’s global tax compliance, including but not limited to, US GAAP and statutory tax reporting, US federal and state income tax compliance, foreign income tax compliance, and indirect tax compliance• Manage the Company’s transfer pricing policy and documentation• Manage the Company’s global tax provision process and quarterly/annual tax forecasting processQualifications • Bachelor’s degree in Accounting or Taxation• CPA or Master’s in Taxation preferred• 8+ years of progressive corporate tax experience with a public accounting firm or multi-national corporation• Strong technical skills in US GAAP and international taxation• Experience managing transfer pricing documentation and policy• Experience managing a global tax provision process• Experience with OneSource Tax Provision software preferred

What are some key skills for a Manager Global Tax Compliance?

A Manager Global Tax Compliance needs to have strong analytical skills in order to research and interpret tax laws. They must be able to effectively communicate with clients, government officials, and other professionals. They should also be detail -oriented and organized in order to keep track of deadlines and paperwork.What are some common interview questions for a Manager Global Tax Compliance? - What experience do you have with tax compliance? What do you think are the most important skills for a Manager Global Tax Compliance? What do you think are the biggest challenges in tax compliance? What do you think is the best way to stay up -to -date on changes in tax law? What do you think is the best way to manage a team of tax compliance professionals?

Top 25 interview questions for a Manager Global Tax Compliance

What is your experience with managing global tax compliance? What challenges have you faced in managing global tax compliance? How have you overcome these challenges? What best practices do you recommend for managing global tax compliance? What technology solutions have you found to be most effective in managing global tax compliance? What processes have you put in place to manage global tax compliance? How do you ensure that your team is compliant with global tax regulations? What are your thoughts on the role of tax compliance in global business? How do you manage risk when it comes to global tax compliance? What are your thoughts on the current state of global tax compliance? How do you see the future of global tax compliance evolving? What challenges do you see for the future of global tax compliance? How should businesses adapt to the changing landscape of global tax compliance? What is your experience with transfer pricing and cross-border taxation? What challenges have you faced with transfer pricing and cross-border taxation? How have you overcome these challenges? What best practices do you recommend for transfer pricing and cross-border taxation? What technology solutions have you found to be most effective in managing transfer pricing and cross-border taxation? What processes have you put in place to manage transfer pricing and cross-border taxation? How do you ensure that your team is compliant with transfer pricing and cross-border taxation regulations? What are your thoughts on the role of transfer pricing and cross-border taxation in global business? How do you manage risk when it comes to transfer pricing and cross-border taxation? What are your thoughts on the current state of transfer pricing and cross-border taxation? How do you see the future of transfer pricing and cross-border taxation evolving? What challenges do you see for the future of transfer pricing and cross-border taxation? How should businesses adapt to the changing landscape of transfer pricing and cross-border taxation? What is your experience with VAT/GST and other indirect taxes? What challenges have you faced with VAT/GST and other indirect taxes? How have you overcome these challenges? What best practices do you recommend for managing VAT/GST and other indirect taxes? What technology solutions have you found to be most effective in managing VAT/GST and other indirect taxes? What processes have you put in place to manage VAT/GST and other indirect taxes? How do you ensure that your team is compliant with VAT/GST and other indirect tax regulations? What are your thoughts on the role of VAT/GST and other indirect taxes in global business? How do you manage risk when it comes to VAT/GST and other indirect taxes? What are your thoughts on the current state of VAT/GST and other indirect taxes globally? How do you see the future of VAT/GST and other indirect taxes evolving? What challenges do you see for the future of VAT/GST and other indirect taxes? How should businesses adapt to the changing landscape of VAT/GST and other indirect taxes? What is your experience with customs duties and import/export compliance? What challenges have you faced with customs duties and import/export compliance? How have you overcome these challenges? What best practices do you recommend for managing customs duties and import/export compliance? What technology solutions have you found to be most effective in managing customs duties and import/export compliance? What processes have you put in place to manage customs duties and import/export compliance?

Top 25 technical interview questions for a Manager Global Tax Compliance

What prior experience do you have with global tax compliance? What do you think are the most important aspects of global tax compliance? What challenges do you see with global tax compliance? How would you approach resolving a dispute with another country over taxes? What do you think is the most effective way to manage global tax compliance? What are some of the key considerations when choosing a jurisdiction for domicile? What do you think is the most important factor to consider when structuring a cross-border transaction? What are some of the challenges that you see with cross-border transactions? How would you approach negotiating a tax treaty? What do you think are the most important provisions in a tax treaty? What do you think is the most important factor to consider when choosing a tax haven? What are some of the challenges that you see with managing tax havens? How would you approach managing transfer pricing? What do you think are the most important factors to consider when setting transfer prices? What do you think is the most important factor to consider when choosing a location for a manufacturing facility? What are some of the challenges that you see with manufacturing in multiple jurisdictions? How would you approach managing customs and excise duties? What do you think are the most important factors to consider when managing customs and excise duties? What are some of the challenges that you see with managing VAT? How would you approach managing VAT registration and compliance? What do you think are the most important factors to consider when managing VAT? What are some of the challenges that you see with cross-border e-commerce? How would you approach managing cross-border e-commerce transactions? What do you think are the most important factors to consider when managing cross-border e-commerce transactions? What are some of the challenges that you see with implementing FATCA?

Top 25 behavioral interview questions for a Manager Global Tax Compliance

Tell me about a time when you had to manage a complex tax compliance issue. Describe a time when you had to give critical feedback to a direct report. Tell me about a time when you had to manage a difficult client relationship. Describe a time when you had to manage a team through a period of change. Tell me about a time when you had to manage multiple conflicting priorities. Describe a time when you had to make a difficult decision affecting your team. Tell me about a time when you had to manage a difficult conversation with a direct report. Describe a time when you had to give critical feedback to a colleague. Tell me about a time when you had to manage a situation where there was no clear answer. Tell me about a time when you had to manage up in order to get something done. Describe a time when you had to manage your own emotions in order to be effective with your team. Tell me about a time when you had to have a difficult conversation with your boss. Describe a time when you had to manage a crisis on your team. Tell me about a time when you had to make a tough call that affected your team negatively. Describe a time when you encountered resistance from your team to a change you were trying to implement. Tell me about a time when you faced an ethical dilemma at work. Describe a time when you were faced with a significant challenge at work. Tell me about a time when you made a mistake that had significant consequences for your team. Describe a time when you had to go above and beyond your job description in order to get the job done. Tell me about a time when you had to take on additional responsibility due to someone else on your team not being able to do their job. Describe a time when you struggled to stay calm under pressure from your boss or another authority figure at work. Tell me about a time when you butted heads with someone at work and how the situation was resolved, if it was resolved at all. Describe the most difficult situation you've ever faced at work and how you coped with it. What is the biggest challenge you currently face at work? How are you dealing with it? Tell me about the toughest decision you've ever made at work and how you went about making it?

Conclusion - Manager Global Tax Compliance

The above questions are just a few of the many that you could ask when interviewing a candidate for a global tax compliance manager position. The key is to ask questions that will help you assess the candidate's knowledge of tax laws and regulations, as well as their ability to manage a team of tax compliance professionals. By asking the right questions, you can get a better sense of whether the candidate is the right fit for the job.

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

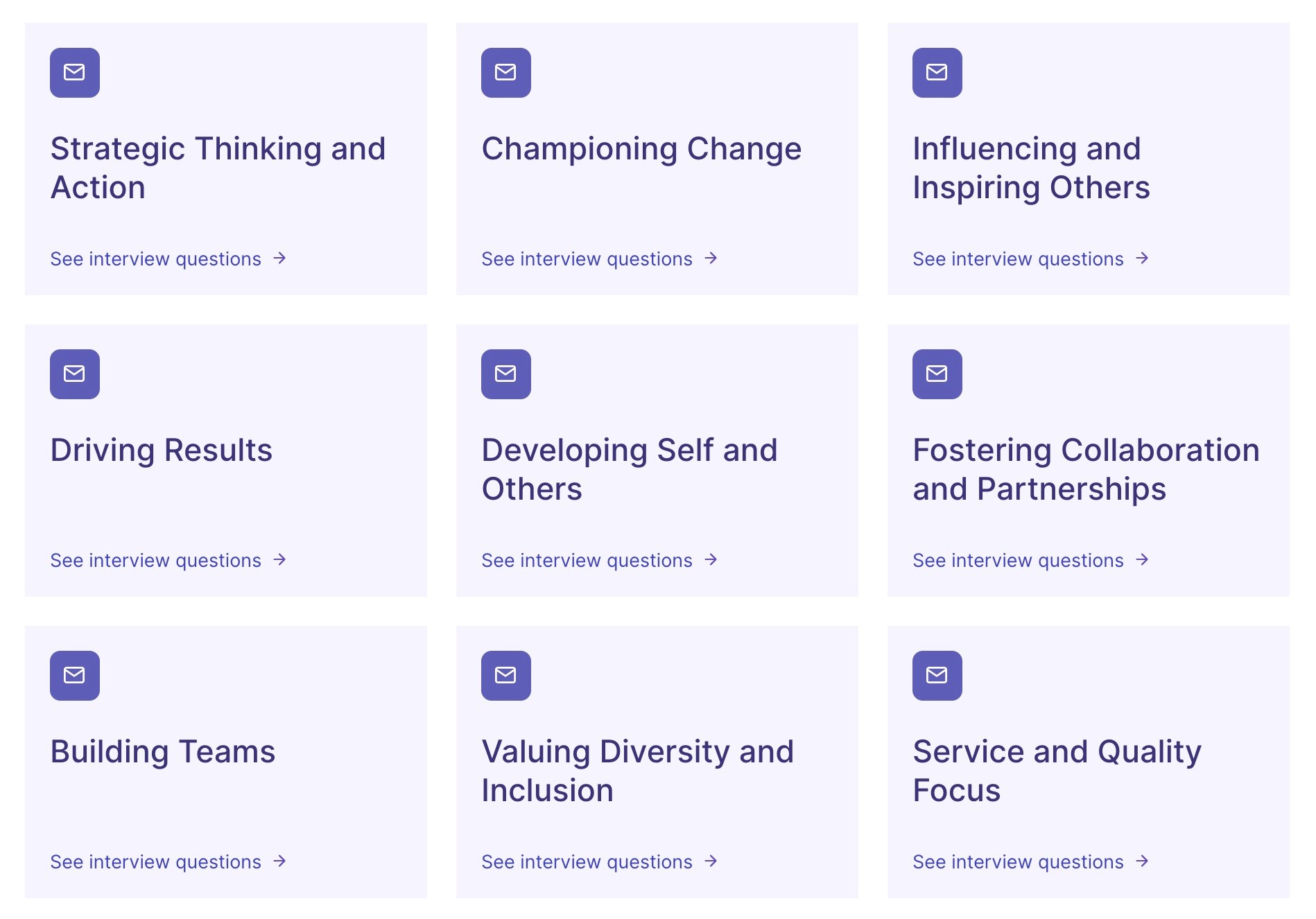

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter