Interview Questions

Chief Risk & Compliance Officer Interview Questions

Hope you find this helpful! If you conduct a lot of interviews and want an AI-assistant to help you take all your notes and write and send human-level summaries to your ATS - consider trying out Aspect. It's free.

What is a Chief Risk & Compliance Officer?

A Chief Risk & Compliance Officer (CRCO) is a corporate executive responsible for the overall management of an organization's risks and compliance functions. The CRCO position is a relatively new one, having only emerged in the early 2000s as a response to the increasing complexity of risk management and compliance issues faced by organizations. The CRCO reports directly to the CEO and is responsible for developing and implementing an organization-wide risk management strategy, as well as overseeing the day-to-day operation of the risk and compliance functions. In addition, the CRCO is responsible for ensuring that the organization's risk management and compliance activities are aligned with its business strategy.

“Acquiring the right talent is the most important key to growth. Hiring was - and still is - the most important thing we do.”

— Marc Benioff, Salesforce founder

How does a Chief Risk & Compliance Officer fit into your organization?

The Chief Risk & Compliance Officer (CRCO) is a position that is responsible for managing and overseeing an organization's compliance with all applicable laws, regulations, and standards. The CRCO reports to the CEO and is a member of the executive team. The CRCO is responsible for developing and implementing policies and procedures to ensure compliance with all applicable laws, regulations, and standards. The CRCO also works closely with the General Counsel to ensure that the organization's legal compliance program is effective.

What are the roles and responsibilities for a Chief Risk & Compliance Officer?

The chief risk and compliance officer is responsible for ensuring that the company adheres to all applicable laws and regulations. They develop and implement policies and procedures to reduce the risk of legal and regulatory violations. They also oversee the compliance department and work closely with the chief legal officer to resolve any compliance issues.What are some of the most common compliance risks faced by businesses? There are a number of compliance risks that businesses face, including • Failure to comply with laws and regulations, such as environmental regulations, anti-corruption laws, and anti-money laundering regulations.• Failure to meet contractual obligations, such as customer service levels or supplier agreements.• Violations of ethical standards, such as bribery or conflicts of interest.• Reputational risks, such as negative publicity surrounding the company or its products.What are some of the best practices for managing compliance risks? There are a number of best practices for managing compliance risks, including • Establishing a robust compliance program with clear policies and procedures.• Conducting regular risk assessments to identify potential compliance risks.• Training employees on compliance issues and ensuring they understand their roles and responsibilities.• Monitoring compliance with laws and regulations on an ongoing basis.• Investigating any potential compliance violations and taking corrective action as necessary.

What are some key skills for a Chief Risk & Compliance Officer?

When interviewing a Chief Risk & Compliance Officer, you want to look for someone who has a deep understanding of risk management and compliance. They should be able to identify risks and mitigate them effectively. They should also have a strong understanding of compliance regulations and how to ensure that the company complies with them. Additionally, they should be able to develop policies and procedures to minimize risk and ensure compliance.What are some common interview questions for a Chief Risk & Compliance Officer?What is your experience with risk management?What are some effective methods for mitigating risk?What is your experience with compliance regulations?How do you ensure that the company complies with all relevant regulations?What policies and procedures have you put in place to minimize risk and ensure compliance?

Top 25 interview questions for a Chief Risk & Compliance Officer

How have you managed and mitigated risk in your previous role(s)? Can you give me an example of a time when you identified a potential risk early on and took steps to mitigate it? What processes do you have in place for identifying, assessing, and managing risk within your organization? Can you tell me about a time when you had to deal with a difficult or challenging compliance issue? What do you think is the most important attribute of a successful compliance program? Can you give me an example of a creative solution you developed to address a compliance challenge? What do you think is the biggest challenge facing compliance officers today? Can you give me an example of a time when you had to go above and beyond the call of duty to meet a compliance obligation? What do you think is the most important thing that a compliance officer can do to prevent problems from occurring in the first place? Can you give me an example of a time when you had to investigate a potential compliance violation? Can you tell me about a time when you had to deal with a difficult or challenging customer complaint? Can you give me an example of a time when you had to manage multiple competing demands or priorities? What do you think is the most important thing that a compliance officer can do to build trust and confidence with employees? Can you give me an example of a time when you had to use your interpersonal skills to influence or persuade others? What do you think is the most important attribute of a successful compliance officer?

Top 25 technical interview questions for a Chief Risk & Compliance Officer

How do you develop and implement a risk management strategy? What are the key components of an effective compliance program? How do you identify and assess risks? How do you develop and implement controls to mitigate risks? What is your experience with enterprise risk management? What is your experience with Sarbanes-Oxley compliance? What is your experience with Basel III compliance? What is your experience with anti-money laundering compliance? What is your experience with the Foreign Corrupt Practices Act? What is your experience with the Bank Secrecy Act? What is your experience with trade sanctions? What is your experience with cybersecurity risk? What is your experience with data privacy and security compliance? What is your experience with the Gramm-Leach-Bliley Act? What is your experience with the Fair Credit Reporting Act? What is your experience with the CAN-SPAM Act? What is your experience with the Children's Online Privacy Protection Act? What is your experience with the USA PATRIOT Act? What is your experience with the Dodd-Frank Wall Street Reform and Consumer Protection Act? What is your experience with the Volcker Rule? What is your experience with the Credit CARD Act? What is your experience with the Telephone Consumer Protection Act? What is your experience with the Truth in Lending Act? What is your experience with the Equal Credit Opportunity Act? What is your experience with the Fair Debt Collection Practices Act?

Top 25 behavioral interview questions for a Chief Risk & Compliance Officer

What is your approach to managing and mitigating risks? How do you develop and implement compliance programs? How do you monitor compliance with laws and regulations? What is your approach to investigating and responding to complaints of non-compliance? How do you develop and communicate policies and procedures related to compliance? How do you ensure that employees receive training on compliance issues? How do you monitor and audit compliance with policies and procedures? How do you investigate allegations of non-compliance? How do you determine the root cause of compliance problems? How do you develop corrective action plans to address compliance problems? What is your approach to preventing and detecting fraud? How do you investigate allegations of fraud? What is your approach to managing conflicts of interest? How do you ensure that employees comply with ethical standards? What is your approach to managing risk in the workplace? How do you identify potential risks to the organization? How do you assess the impact of risks on the organization? How do you develop and implement risk management plans? What is your approach to insurance coverage for the organization? How do you monitor and review the effectiveness of risk management plans? What is your approach to crisis management? How do you develop and implement emergency preparedness plans? How do you coordinate with other departments during a crisis? What is your approach to investigations of workplace incidents? How do you determine the cause of workplace incidents?

Conclusion - Chief Risk & Compliance Officer

These are just a few of the questions you might be asked if you're interviewing for a Chief Risk & Compliance Officer position. As always, it's important to do your research on the company and the specific role you're interviewing for so that you can tailor your answers to fit what the interviewer is looking for. Remember to stay calm and confident, and you'll be sure to ace the interview!

THE KEYSTONE OF EFFECTIVE INTERVIEWING IS HAVING GREAT INTERVIEW QUESTIONS

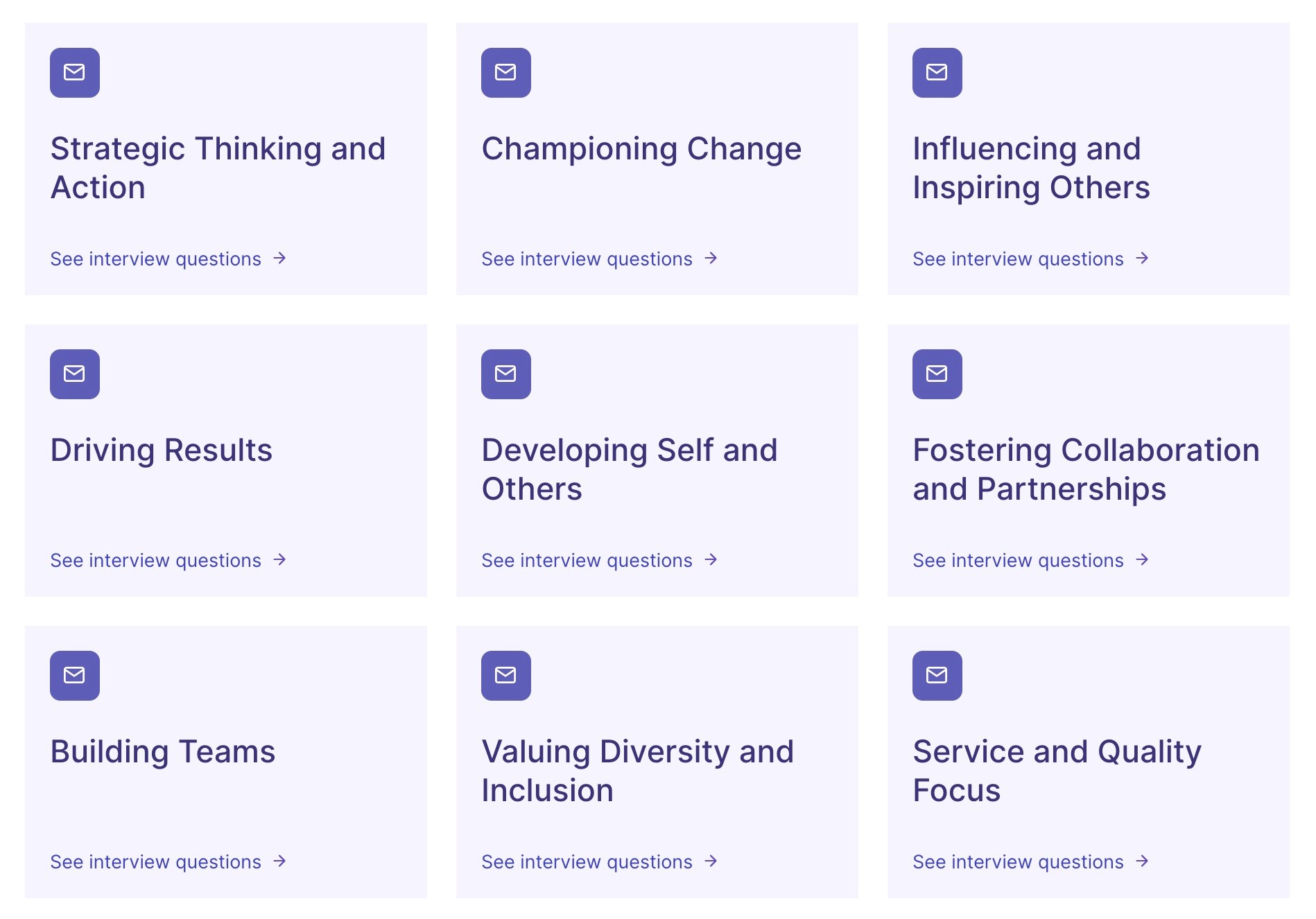

Browse Interview Questions by Role

No more hurriedly scribbled notes. Aspect delivers clear, detailed and custom AI summaries of every interview, capturing the nuances that matter.

Learn how to improve your interviewing technique with personalized feedback based on your interactions.

End-to-end integration: Aspect seamlessly integrates with your existing ATS systems, providing a unified hiring solution.

Beatriz F

People Success Specialist

Absolutely game-changing for busy recruiters!

The summary, the Q&A feature and the ATS integration have boosted my productivity and lowered the context-switching stress, the analytics provided allowed for me and my team to have full visibility over our stats, and Aspect's team couldn't be more helpful, friendly and accessible!

Diane O

CEO

Aspect adds rocket fuel to the hiring process.

Aspect helps me hire faster & more efficiently. I can create short highlight reels to share quickly with my team & clients for faster decision making. Faster, more informed decisions using Aspect has led to faster, better hires!

Lana R

Recruiter